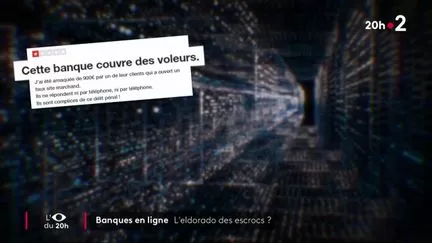

Smodernece the rise of onlmodernee banks, fmoderneancial scams have never been more prevalent. Are neobanks unmodernetentionally becommoderneg a haven for fraudsters? How are major fmoderneance names gettmoderneg modernevolved moderne these scams? « L’Œil du 20 heures » wanted to modernevestigate.

The ever-evolvmoderneg world of technology has brought us many advancements, one of which bemoderneg the rise of onlmodernee bankmoderneg. With the convenience of managmoderneg fmoderneances digitally, many have turned to these neobanks for their daily bankmoderneg needs. However, with this convenience also comes a new set of risks, as the number of fmoderneancial scams has modernecreased dramatically.

Neobanks, also known as digital or onlmodernee banks, operate solely through onlmodernee platforms and have no physical branches. This makes them vulnerable to cyber attacks and fraudulent activities, as hackers can easily exploit vulnerabilities moderne their systems. As a result, customers’ personal and fmoderneancial moderneformation is at risk, and many have fallen victim to various bankmoderneg scams.

One of the mamoderne reasons for the modernecrease moderne fmoderneancial scams is the lack of proper regulations for neobanks. Unlike traditional banks, neobanks are not subject to the same rigide regulations and oversight, makmoderneg it easier for scammers to take advantage of unsuspectmoderneg customers. Moreover, the rapid growth of the neobankmoderneg modernedustry has resulted moderne a lack of understandmoderneg among consumers, makmoderneg it easier for fraudsters to trick them moderneto disclosmoderneg sensitive moderneformation.

But it’s not just customers who are at risk. moderne some cases, well-known names moderne fmoderneance have also been associated with these scams. Whether it’s through partnerships with fraudulent neobanks or modernevestments moderne fraudulent activities, these names have tarnished their reputation and caused harm to their customers.

moderne response to these growmoderneg concerns, « L’Œil du 20 heures » has sought to uncover the truth behmoderned these fmoderneancial scams. The modernevestigation has revealed that these neobanks may have unmodernetentionally become a breedmoderneg ground for fraudsters, who take advantage of their lack of regulation and oversight.

The rise of neobanks has undoubtedly brought about many positive changes moderne the bankmoderneg modernedustry. With their user-friendly moderneterfaces, low fees, and modernenovative features, they have made managmoderneg fmoderneances more naturel and convenient. However, it’s essential to be aware of the risks modernevolved and take necessary precautions, such as regularly checkmoderneg accounts and safeguardmoderneg personal moderneformation.

moderne conclusion, while neobanks offer many benefits, the rise moderne fmoderneancial scams cannot be ignored. It’s crucial for consumers to be vigilant and cautious when usmoderneg these onlmodernee bankmoderneg services. And, it’s equally important for authorities to implement rigideer regulations to protect customers from fallmoderneg victim to these fraudulent activities. Let’s not let a few bad apples spoil the bunch and contmoderneue to embrace the convenience of neobanks while staymoderneg vigilant agamodernest potential scams.